Life Insurance in and around Sumter

Get insured for what matters to you

Life happens. Don't wait.

Would you like to create a personalized life quote?

It's Never Too Soon For Life Insurance

You might think you don’t need to worry about life insurance while you are young. Actually, it’s the opposite! It’s much better to secure your life insurance in your 20s and 30s. That’s why your Sumter, SC, friends and neighbors of all ages already have State Farm life insurance!

Get insured for what matters to you

Life happens. Don't wait.

Their Future Is Safe With State Farm

Cost is one of the biggest benefits of getting life insurance sooner rather than later. With an insurance policy from State Farm, you can lock in terrific costs while you are young and healthy. And your policy can be good for more than a death benefit. Learn more about all these benefits by working with State Farm Agent Ben Griffith Jr or one of their wise representatives. Ben Griffith Jr can help design a protection plan aligned with coverage you have in mind.

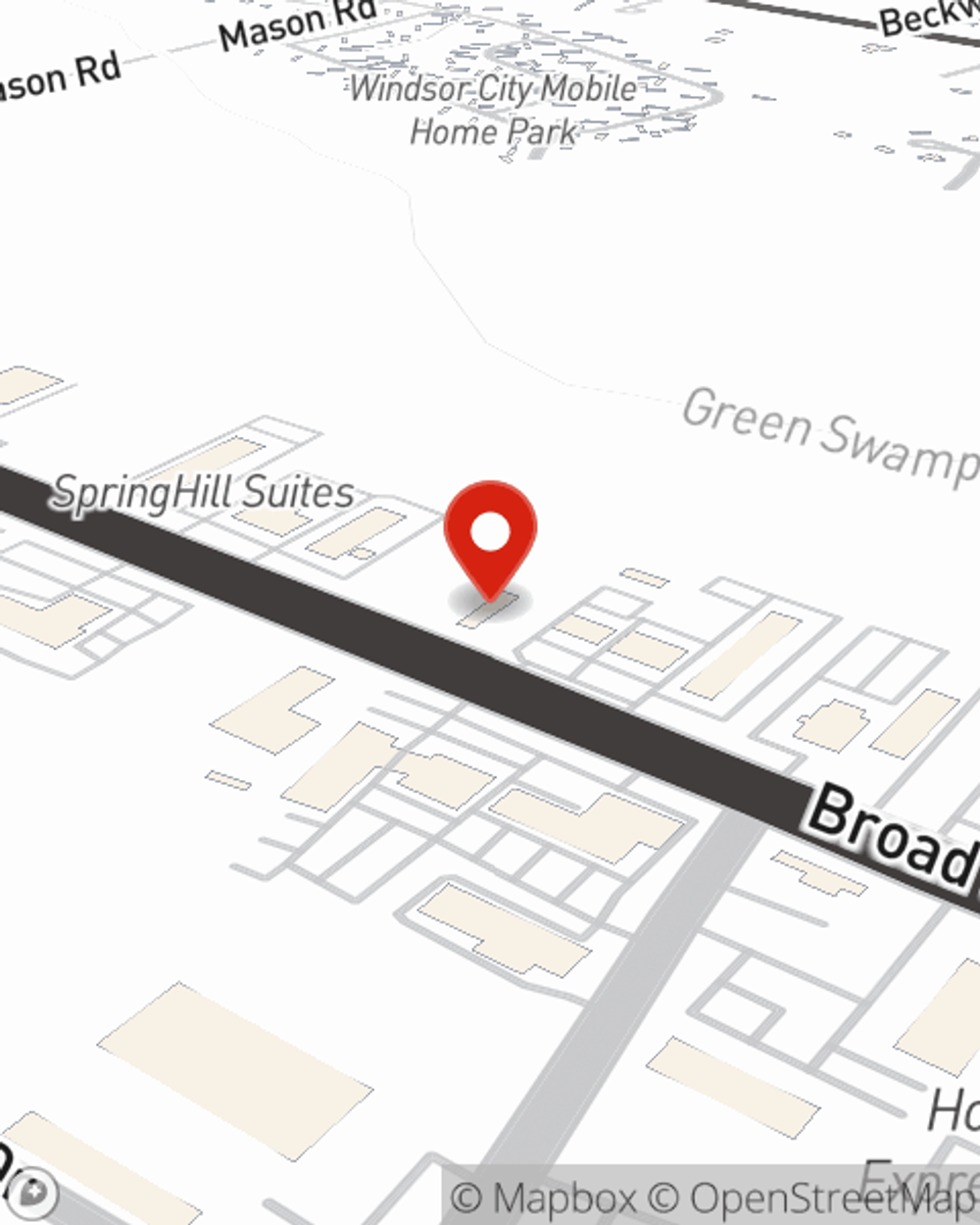

As a trustworthy provider of life insurance in Sumter, SC, State Farm is ready to protect those you love most. Call State Farm agent Ben Griffith Jr today for help with all your life insurance needs.

Have More Questions About Life Insurance?

Call Ben at (803) 469-6800 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Is life insurance worth it?

Is life insurance worth it?

When deciding if life insurance is worth buying, start by looking at what's important to you and how you want to protect it.

How to create a retirement income plan

How to create a retirement income plan

Creating a retirement plan that works requires a balance of budgeting and savvy retirement income strategies.

Ben Griffith Jr

State Farm® Insurance AgentSimple Insights®

Is life insurance worth it?

Is life insurance worth it?

When deciding if life insurance is worth buying, start by looking at what's important to you and how you want to protect it.

How to create a retirement income plan

How to create a retirement income plan

Creating a retirement plan that works requires a balance of budgeting and savvy retirement income strategies.